Service Dénouement des transactions

Settlement of transactions

The settlement-delivery (S&D) of stock market sessions is one of the responsibilities assigned to the DC/BR in the regional financial market. Initially planned over a period of five (5) business days following the stock transaction, it was reduced to three (3) days in 2007, allowing the DC/BR to align with international standards for the settlement cycle.

Within this allotted timeframe, the DC/BR acts as the central counterparty to carry out operational procedures, ensuring the simultaneous and timely delivery of securities and payment of funds to market participants.

PRESENTATION OF THE SETTLEMENT AND DELIVERY CYCLE

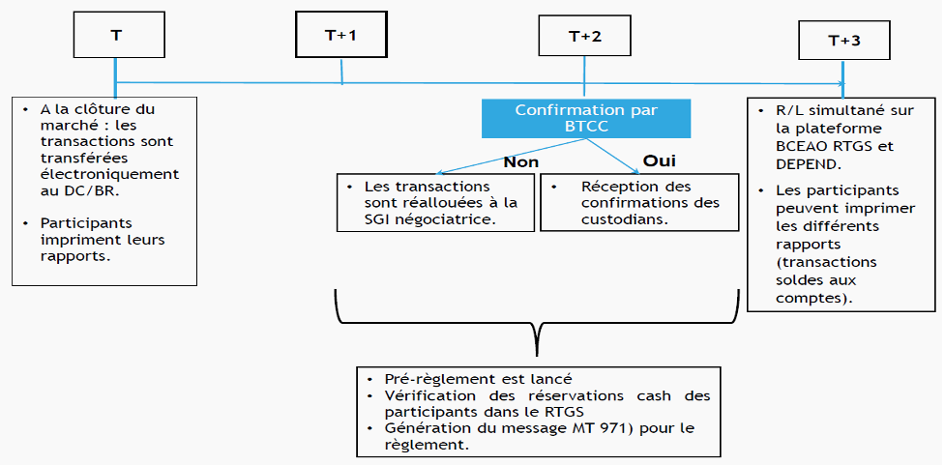

The settlement and delivery of stock market transactions in the regional financial market follow these key steps :

- Execution of transactions on the stock market

- Transfer of trading session transactions to the DC/BR

- Verification of data received from the Stock Exchange

- Generation and review of statistical reports

- Confirmation of transactions by account holders-custodians before T+2 at 09:00 AM

At T0 :

This deadline marks the generation of the day's statistical reports and the daily settlement reports, which are communicated to account holders-custodians.

At T+2 :

If a transaction is executed by a Management and Intermediation Company (SGI) using an account held by an account holder-custodian, the DC/BR collects confirmation from the custodian by T+2 at 09:00 AM. If confirmation is not received, the DC/BR automatically reallocates the transaction to the SGI that conducted the trade. This reallocation incurs a penalty payable by the executing SGI.

Pre-settlement of transactions: Blocking of securities positions.

Verification of fund reservations in the BCEAO's "STAR UEMOA" system and follow-up with members who have not completed their reservations.

At T+3 :

At the settlement deadline for stock market transactions, the DC/BR carries out clearing at T+3, starting at 8:00 AM, following the "all-or-nothing" rule: cash clearing is executed in the STAR-UEMOA system only if sufficient provisions are available for all relevant members. Simultaneously, the DC/BR proceeds with the delivery of securities in its operating system (DEPEND).

In case of insufficient funds, the clearing session is immediately rejected in the STAR-UEMOA system, and the DC/BR initiates the incident management procedure.